The Immigrant Investor Program of the U.S., also known as “EB-5” (Employment Based Fifth Preference), was created by Congress in 1991 under the US immigration law to stimulate the U.S. economy through job creation by immigrant investors. EB-5 program directs foreign investment into projects that revitalize local economies; investors whose money creates at least 10 full-time jobs for U.S. workers become eligible for a U.S. green card.

In 1993 and regularly reauthorized since then, the Regional Center Pilot Program has been in effect, which makes it easier to qualify for the10 full-time job creation requirements under the EB-5 immigration rules. This also allows such petitions to count as both direct and indirect/induced jobs. The Regional Center Pilot Program makes the EB-5 program into an attractive immigration program with less minimum amount of required investment, the short processing time and less eligibility requirements for its applicants.

The EB-5 program is administered by the United States Citizenship and Immigration Services (USCIS), a division of the United States Department of Homeland Security.

Qualifying investors and their spouse and their unmarried minor children (under 21 years old) will be granted US Lawful Permanent Residency

No minimum requirements as to age, English proficiency, employment experience, or education

Investors and family may live/work anywhere in the United States. Minor children may obtain employment, subject to age, state and governmental laws and regulations.

Education benefits including admission to Universities at US resident costs.

The EB-5 program does not require immigrant investors to manage their investment on a day to day basis.

After five years, the investors and their family may obtain US citizenship, subject to meeting all immigration requirements, as required under law.

For investments in areas other than "targeted employment areas," the minimum amount of investment is $1.8 million USD.

To "invest" is to contribute equity or capital to the enterprise. The individual investor cannot receive any bond, note, or other debt arrangement from the enterprise in exchange for the contribution of capital. This also includes the idea the investor buys a house or condo as this is prohibited also. This includes any stock redeemable at the holder’s request. Provision for guaranteed returns and redemptions will be classified by the USCIS as impermissible debt arrangements. Also, the applicant’s personal guarantee of a loan that is the primary obligation of the enterprise does not constitute an equity investment of capital by the applicant.

The USCIS requires proof that the capital invested is "at risk". The USCIS focuses on actual and intended uses of capital to confirm the capital will be spent according to the submitted comprehensive business plan as outlined in the partnership documents. Further the USCIS will review documents submitted to show that all ($1,800,000 or $900,000 if qualified) EB-5 capital will be used for job creation and profit-generating activity.

Any person who can demonstrate the ability to: 1) deploy the required amount into the American economy, 2) document that the capital was legally earned, and 3) satisfy general eligibility requirements (e.g., medical, criminal) is qualified to apply for the EB-5 program. There are no language, business, or education requirements for applicants.

In 1993 and regularly reauthorized since then, the Regional Center Pilot Program has been in effect, which makes it easier to qualify for the10 full-time job creation requirements under the EB-5 immigration rules. This also allows such petitions to count as both direct and indirect/induced jobs. The Regional Center Pilot Program makes the EB-5 program into an attractive immigration program with less minimum amount of required investment, the short processing time and less eligibility requirements for its applicants. There are no language, business, or education requirements for applicants.

The EB-5 program allots 10,000 visas per year for aliens and family members whose qualifying investments result in the creation or preservation of at least ten (10) full-time jobs for U.S. workers. A minimum of 3,000 immigrant visas are set-aside for aliens who invest in designated regional centers with areas of high unemployment or other qualifying areas.

A minimum of 3,000 immigrant visas are set-aside for aliens who invest in designated regional centers.

No financial sponsor is required to file the green card petition.

No minimum requirements of age, English proficiency, work experience and educational background.

Allow the petitioners to count Indirect Job Creation and Induced Job Creation when filing an immigration petition, which enhances their case for approval.

Investors through a regional center are not required to participate in the daily operating management of the investment business; the operating risk is greatly reduced compared to direct EB-5 investment in a US company for over $1 million.

Qualified investors, their spouses and their unmarried children under the age of 21 can apply for US lawful permanent resident status all together.

Top-tier Eb-5 immigration lawyers in the US, and top NY securities lawyers.

USCIS employment and economic impact assessments by Evans, Carroll & Associates or Jeffery Carr.

TEA certification issued by New York State Department of Labor.

Project market survey by KTR Real Estate Advisors.

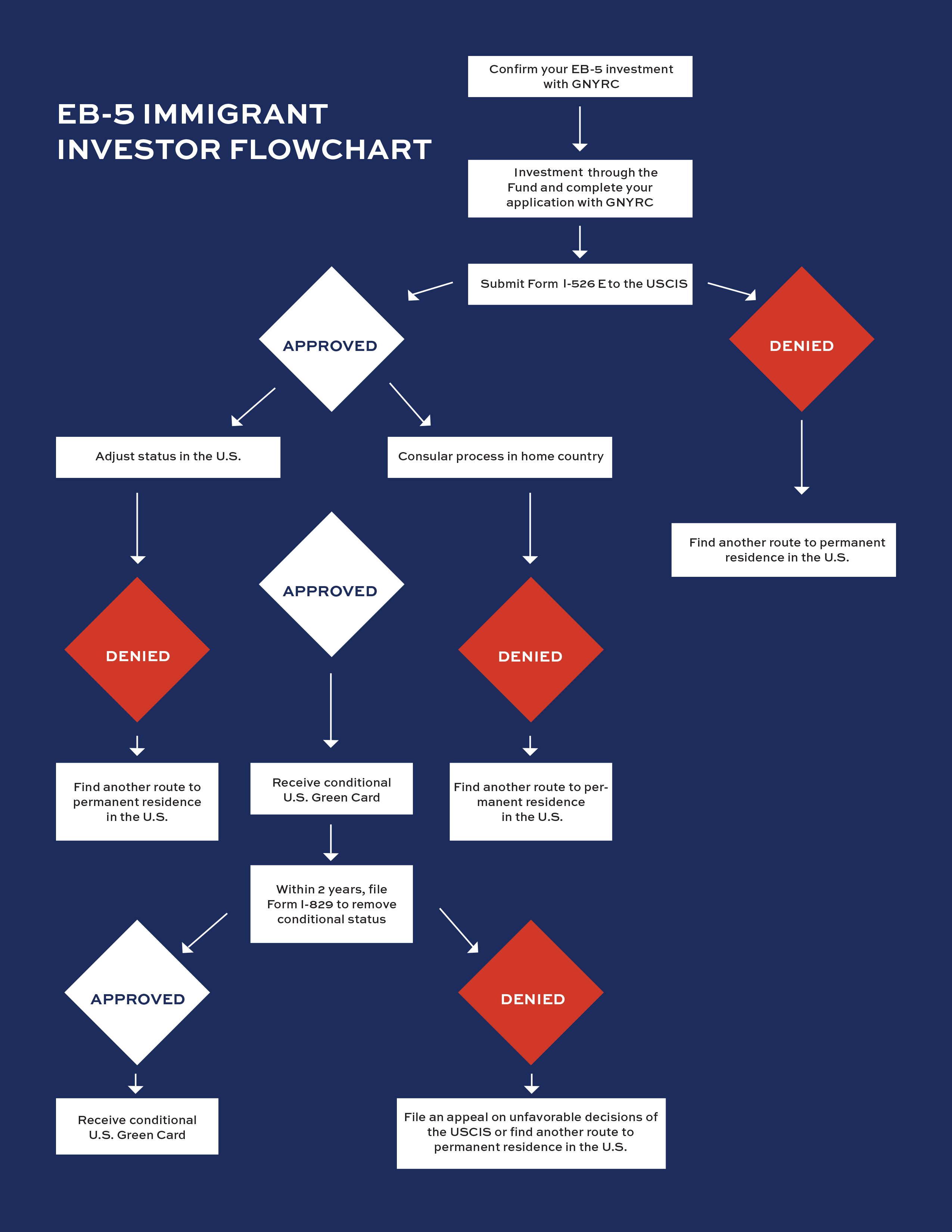

Application Process

Investor confirm their intent to invest

Regional Center confirms the eligibility of investor under EB-5 regulation

Investor signs agreements with Regional Center and Fund Company, respectively, and wires investment funds and application fees to the designated bank accounts

Immigration lawyer files I-526 Petition with USCIS

Approval of I-526 Petition

Investor has an interview at the US embassy and obtains an immigrant visa; (For investors located in the United States, Form I-485 for adjustment of status is required instead.)

Investor is eligible to apply for an immigrant visa to enter the US and will be given conditional lawful permanent residency status for two years.

Ninety (90) days before the end of the two-year period of conditional residency, the immigration attorney must file Form I-829, to remove the conditional status.

If the I-829 application is approved, the investor will be granted unconditional permanent resident status.

After obtaining unconditional permanent resident status (a green card) and meeting the requirement, the green card holder can apply for U.S. citizenship.

NO OFFER TO SELL ANY SECURITY IS MADE BY THIS WEBSITE. THE INFORMATION ON THIS WEB SITE IS NOT AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY AN INTEREST IN ANY INVESTMENT OR FOR THE PROVISION OF ANY INVESTMENT MANAGEMENT OR ADVISORY SERVICES. ANY SUCH OFFER OR SOLICITATION WILL BE PURSUANT TO EXEMPTIONS FROM REGISTRATION REQUIREMENTS SET OUT IN APPLICABLE SECURITIES LAWS AND MADE ONLY BY MEANS OF DELIVERY OF A CONFIDENTIAL PRIVATE OFFERING MEMORANDUM RELATING TO A PARTICULAR INVESTMENT TO QUALIFIED INVESTORS IN THOSE JURISDICTIONS WHERE PERMITTED BY LAW. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.